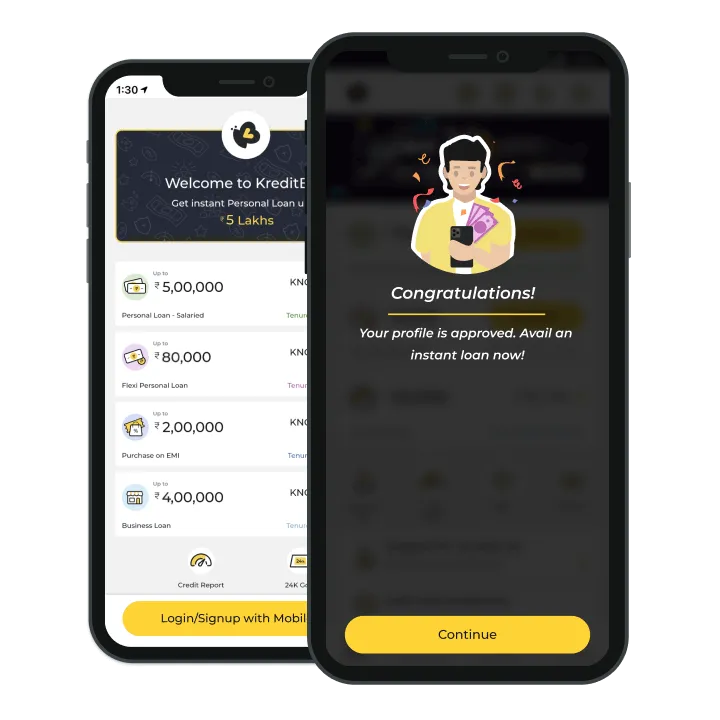

KreditBee App

How to take loan with KreditBee Loan

Friends, if you too have to face a lot of difficulties due to money. If you are also tired of asking for money from friends and there is no other option than this, then there is no need to worry because you have another option by which you can end your problem and that is loan. Friends, although there are many companies and apps that give loans online, but today I am going to tell you about the loan app, the name of that app is –Kreditbee Loan App. Let us start and know everything about this reliable loan app Kreditbee.

Table of Contents

What is KreditBee?

Friends, Kreditbee Loan App is an online loan lending platform. You can easily apply for the loan from here. This loan app is approved by NBFC. So you can absolutely trust this app. Friends, this app is giving loan in all over India since 2018. Friends, if I talk about its download, then more than 10 million downloads of this app have been done on Play Store so far.

How Much loan can be taken via KreditBee?

Friends, if we talk about Kreditbee Loan App here, then you will get a loan of at least 1000 and maximum up to 5 lakhs.

How much interest will be charged by KreditBee Loan?

Friends, before taking a loan, the most important thing we should know is that how much interest is being charged on the loan so that we do not have any problem later. Friends, now if I talk about Kreditbee Loan App here, then you will get 1.02% – 2.49% per month interest in it.

How much time will you get to repay the loan?

Friends, if we know that after how much time we have to pay back the loan, then we can juggle our money accordingly, then it is important for us to know this. If I talk about Kreditbee Loan App, then in this you get 62 days to 15 months to repay the loan amount.

How to Pay EMI on Kreditbee

If you’re struggling to pay your Kreditbee EMI, you’re not alone. Fortunately, there are several options available to help you make your payments on time and avoid any late fees.

Pay your Kreditbee EMI with ease.

Log in to your Kreditbee account.

The first step to paying your Kreditbee EMI is to log in to your account. You can do this by visiting the Kreditbee website or downloading the Kreditbee app on your mobile device. Once you’ve logged in, navigate to the “Payments” section of your account. Here, you’ll be able to see your outstanding EMI amount and the due date for your payment.

How many types of Kreditbee Loans are there?

- Flexi Personal Loans

- Personal Loan For Salaried

- Online Purchase Loans

What are the documents required to take Kreditbee Loan?

- For Flexi Personal Loans – (Pan Card ,Address Proof)

- For Personal Loan For Salaried – (Pan Card ,Address Proof, Salary Proof)

How to take loan from Kreditbee Loan App?

- First of all you have to download Kreditbee Loan App from Play Store.

- After that you have to register in it with your mobile number.

- After that you have to enter your basic information in it.

- After that you have to upload your KYC Documents in it.

- Provide Bank Account Details.

- Choose your loan amount and tenure .

- Then your loan will be approved and the money will be disbursed into your account.

- Use Coupon Code: DS100 – Up to 100% off on processing Fees

- Use Coupon code : KRED50 – up to 50% off on PF for General Users

- Use Coupon Code : EASY50 – Flat 50% Off on PF for eligible users.

Why Kreditbee Loan App?

- No credit history is asked from you here.

- This process is 100% online.

- You can apply for a loan from here at any time.

- Loans are available very quickly from here.

- Here you will get many options to pay back the loan.

How to Pay EMI on Kreditbee

If you choose EMI repayment option while taking a loan from Kreditbee app, you will be able to pay your loan in easy monthly installments with some extra interest. The good news is that there are several options available to help you make your Kreditbee EMI payments on time and avoid late fees.

Pay your Kreditbee EMI with ease.

Log in to your Kreditbee account.

The first step to paying your Kreditbee EMI is to log in to your account. You can do this by visiting the Kreditbee website or downloading the Kreditbee app on your mobile device. Once you’ve logged in, navigate to the “Payments” section of your account. Here, you’ll be able to see your outstanding EMI amount and the due date for your payment.

You can also get a personal loan easily through Google Pay.

Kreditbee Loan Customer Care Number

EMail: help@kreditbee.in

Call: 08044292200

Friends, in today’s post, that’s all, today we learned how you can take a loan from a great loan company called ” KreditBee Loan”. We have provided you with detailed information regarding required documents, eligibility criteria and others to necessary information for making things easy for you.

If you have any other question regarding KreditBee Loan or any other suggestions do write to us or comment below. Stay safe and see you in our next post.

FAQs

What are the benefits of a personal loan?

Getting personal loans from KreditBee is a breeze, with funds typically landing in your account within a mere 5 minutes. Acquire the funds you require swiftly and effortlessly, without any unnecessary complications.

What is a personal loan interest rate ?

Interest rates for loans vary based on the loan amount and duration. Depending on several factors, you can secure a loan with interest rates ranging from 1.02% to 2.49% per month.

How can I get a personal loan in one day?

Simply download the KreditBee app or visit their website. Complete a straightforward documentation process and apply for the loan you require. The entire process, including disbursal, can be wrapped up in just 10 minutes from start to finish.

What are the eligibility requirements for a personal loan?

To qualify for a personal loan, you must meet the following eligibility criteria: You must be between 21 and 45 years old. Your net monthly income should exceed Rs. 10,000. You must be a citizen of India.

Can I get a personal loan without a salary slip?

Indeed, you can apply for a flexi personal loan without needing a salary slip.

How can I get a personal loan without a credit score ?

Certainly, KreditBee welcomes customers who are new to credit. They consider various factors beyond just the credit score to assess your repayment capacity.