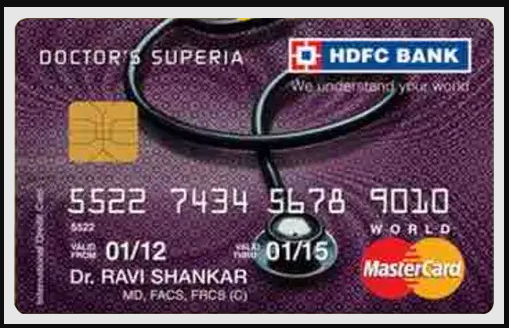

HDFC Doctor’s Superia Credit Card is an exclusive credit card for salaried and independent doctors. The privileges and incentives that come with this card are unmatched in their exclusivity. In addition to having a high level of security, this credit card offers its users a number of advantages. Extra Reward Points, foreign travel redemption, meal savings, and Priority Pass Membership are just a few of the many advantages. One of the most valued perks offered by HDFC on this card is an affordable revolving credit limit combined with a 50-day interest-free grace period for the cardholder. For more information on this card, keep reading!

Features of HDFC Doctor’s Superia Credit Card

The advantages of the HDFC Doctor’s Superia Credit Card are as follows:

- 1000 Reward Points will be accrued as a welcome bonus when you use this card.

- As a renewal benefit for this card, take advantage of the accumulation of 1000 Reward Points.

- Join the Doctor’s Superia Travel Club to have your reward points used for travel.

- International Miles: Through Singapore Carriers’ KrisFlyer frequent flyer programme, you may maximise your travel with foreign airlines by redeeming your reward Points at more than 20 foreign airlines. You may sign up for a KrisFlyer membership by registering using the company’s official website.

- India Miles – Take advantage of domestic travel by converting your reward points into miles on the two most popular airlines in India, Jet Airways and Air India. You may use your reward points to purchase plane vouchers from other popular Indian airlines.

- Draw three reward points for every expenditure of up to 150 on the Doctor’s Superia programme. On more than 20 local and foreign carriers, the earned reward points can be exchanged for air miles. 30 Air Miles or 70 Air Vouchers are equal to 100 Reward Points.

- Additionally, these reward points can be used to purchase tempting gift deals from a premium rewards catalogue.

- Only retail purchases can be used to redeem reward points. Reward Points may only be utilised for purchases that total more than 150.

- With Power Dining, you can earn 50% more Reward Points on every dining purchase, making every meal more enjoyable for you.

- Access the advantages of free Priority Pass Membership, which grants the card holder privileged access to more than 600 airport lounges worldwide, regardless of the class of travel or airline used to get there. Take use of the conference rooms, phones, fax machines, enticing refreshments, and much-needed rest and relaxation that are available in these lounges. You may avoid the craziness of the airport and keep exhaustion and irritation at bay with a Priority Pass Membership.

- Fuel Surcharge Waiver: In addition to the 2.5% fuel surcharge waiver and any relevant taxes, take advantage of the convenience fee of 1% plus taxes.

- Secure and Safe Transactions: Since this credit card has a chip, you may be confident that no fraudulent transactions will be made with it.

- A missing card carries no liability: Take use of the HDFC 24-hour contact center’s service to report a lost card and avoid being held responsible for any fraudulent transactions made using the lost card.

- Revolving Credit: Enjoy the low and reasonable interest rates on your credit card with this revolving credit limit feature.

- No-interest credit: Enjoy 50 days from the date of issue without paying interest.

- Bonus points Validity: From the date of accrual, the Reward Points are valid for up to 2 years.

- Earn 8000 Air Miles and/or the matching Air Voucher. This is valid when using reward points that were acquired via spending 5 lakh, of which 20% was spent on eating.

- Make an annual saving of up to Rs.8,300.

- Get exclusive advantages by using the free Priority Pass.

- Get the greatest benefits of the most popular lounge programmes at domestic and international airport lounges.

- For purchases made during the first 90 days of the card’s establishment totaling 15,000 rupees, you can receive charge reversal for the first year.

- Get a fee refund for renewing your card if you spent at least Rs. 100,000 in the year prior to the renewal date.

Features, fees & charges

When it come to various fee or charges like membership/ membership renewal/ Membership / Membership Renewal/Revolving credit limit/ Cash Withdrawal Limit/Interest Rate/ Cheque return fees/ De-blocking fees then friends it is in accordance with bank policies

Eligibility Criteria for HDFC Doctor’s Superia Credit Card

For those who intend to apply for this credit card, HDFC Bank will adhere to the following eligibility requirements:

Maximum age:

Salaried Doctors: This credit card is available to salaried doctors who are at least 21 years old and under the age of 60.

Self-employed doctors: Self-Employed Doctors older than 21 and younger than 65 are eligible to apply for this credit card.

Monthly income: To qualify for this credit card, the applicant must demonstrate a reliable and respectable source of income.

Required documents

The following list of papers is essential to apply for this credit card:

- ID Verification: Copies of your passport, PAN card, UID, driver’s licence, or voter ID card

- Income Verification: Form 16 or the most recent Income Tax Return Documents (for those who are employed in government offices of PSUs)

- Address verification requires a copy of a passport, a fixed line bill, an electricity bill, a UID, and the bank passbook of a PSU bank.

- a copy of the last three months’ worth of PAN card bank statements

Apply online at HDFC Doctor’s Superia Credit Card.

By visiting online at HDFC website https://bit.ly/3XEdeWG , you can apply for HDFC Doctor’s Superia Credit Card .

HDFC Doctor’s Superia Credit Card Status

The HDFC Doctor’s Superia Credit Card Status app allows users to monitor the status of their credit card applications from any location at any time. By using this service, the applicant may save a significant amount of time and effort that would otherwise be spent making repeated trips to the bank’s location or contacting the credit card executive to inquire on the status of their application. Using the special login ID supplied by the bank during the application procedure, this status may be viewed through the HDFC Bank client portal.

HDFC Doctor’s Superia Credit Card Status

At HDFC , which also uses a staff of executives to inform users of the progress of card applications, this is possible. In fact, the committed staff doesn’t stop until your application is approved, making sure the process is quick and easy. The 24-7 staff will promptly let you know if there are any issues with your application, but, if they do. By following the suggestions, you can resubmit your application and receive a decision as soon as possible.

Statement for the HDFC Doctor’s Superia Credit Card

Any transaction made by the cardholder using this credit card is documented in the HDFC Doctor’s Superia Credit Card Statement. With this very useful feature, the cardholder may continuously monitor the transactions and expenses made with this card. For the record, this statement contains information on each and every use of the card since it was first issued. This feature may also be utilised very sensibly to track costs and take the necessary action to balance them out with repayments.

HDFC Doctor’s Superia Credit Card Bill Payment

So an HDFC Bank statement that had a charge for xxx rupees landed in your inbox? You’re considering the ways in which you can make the payment. You may choose to pay using debit cards or utilise Internet Banking, so there’s no need to worry. Cash or a check may even be used to pay the bills. The fastest and most secure manner of paying is, however, online.

24 hour customer service number

The bank’s strong and efficient HDFC Client Care section responds to customer questions and issues about its products. Through the bank’s official website, one may contact them. The bank’s website also lists the toll-free lines that HDFC offers. Alternately, if you want to resolve specific difficulties in person, you may always stop by the closest HDFC bank and speak with an executive there.