Tide is an online business bank which is based on the United Kingdom (UK). Now, it’s also operational in India as well. Everything in Tide banking is digitalized and there is not any physical branch of the Tide Bank, its 100% dedicated to businesses.

Tide App makes your business easy and simple and also you can earn rewards for each and every transaction. Opening an account with Tide is completely free, and as a business owner, you can get a Tide Card as well as Expense Cards for your employees.

Everything you need to know to run your business by using Tide App:

As you already know that Opening a bank account with Tide is very simple and easy – apply in minutes and unlock a lots of financial management tools which help you run your business smoothly.

Business Account

Open you business account quickly and hassle free and easily manages your finances.

Expense Card

You can use the card for business purchases, track expenses, and earn lots of rewards and cashback.

Invoice Generator

You can easily generate the Invoices through Tide App and directly send to your clients.

Bill Pay Feature

Pay your bills smoothly through Tide App and earn points .

Loan

You can get loans up to 10 Lakhs to fulfill your business requirements.

QR code Payments

Accept payment very fastly and smoothly from Customers by using QR code of Tide App.

To Know How To Open the Tide Business Account:

First of all fill the all basic details by using this link https://bit.ly/3wleQug and then you will redirect to download the Tide Business App through Google Play Store

Provide your Email Address and Mobile Number .

Click on add a referral code and input TBA123 , this will give you some extra advantages.

After that proceed to next.

Complete the email addresses verification and set up a password which is 14 minimum characters including numbers and alphabet as well.

Enable your biometrics and complete mobile verification through OTP.

Enter personal details such as name, DoB, PAN ,and communication address .

Provide your business details including Business name, address its category and required inputs as well.

Choose the business category from the drop down list.

Enter your mobile OTP again and proceed for Video KYC.

Complete your Aadhar verification through OTP.

If the customer is registered with Digilocker , then he/she will verify KYC directly through Digilocker

For occupation verification, upload the PAN Card Photo and verified herself/himself.

Complete the Video KYC, which includes a live selfie.

Ensure while Video KYC that PAN Card is handy with you because App also captures the photo of PAN Card.

Once the account is successfully opened (when you received the confirmation email or details on Mobile Phone), then customer needs to deposit minimum rupees 1000 within 7 days of account opening.

Benefits of Tide Business Account in India:

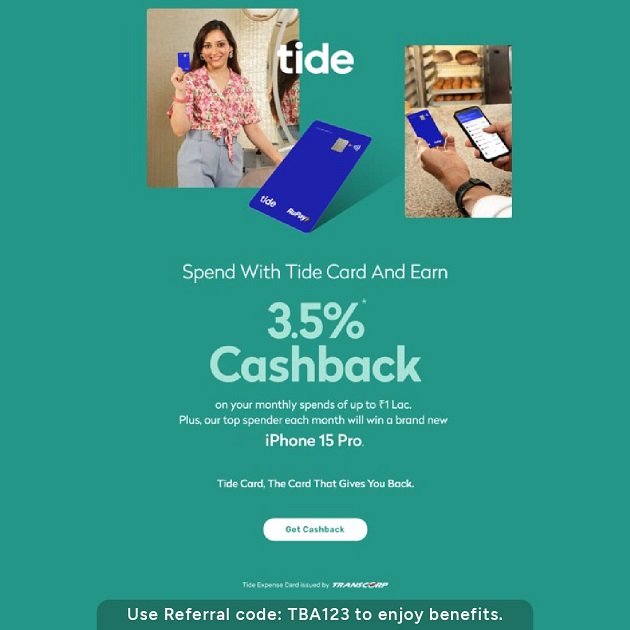

Enjoy exclusive offers with the Tide Business Expensive Card. You will get up to 3.5% cashback on monthly expenses of up to Rs. 1 Lac. The more you expense, the chances of more you earn. Our Top spender each month will win an i phone 15 pro, so don’t miss out on the grand prize.

By using Tide App, you can effortlessly manage and schedule your payments.

Generate GST invoices for free.

Streamline your expenses.

You can directly manage your debits through App.

Get all your needs from your Tide Business bank Account.

There are more than 50,000 limited company owners, traders and freelances have already chosen a Tide Business Bank Account.

There are not any extra hidden charges for using Tide Business App.

You can easily create, send and track invoices payment through the Tide business App.

You can seamlessly integrate your accounting software and bank account with Tide Business app for effortlessly reporting.

Tide ensures you 24X7 banking with safety and security of money.

For any kind of assistance you can initiate chat through Tide Business App any time.

FAQ’s

Who can open a Tide Business Account?

For opening a Tide Business Account, applicants must follow the given criteria:

Applicant’s age should be 18 years old.

Their AADHAR Card must be linked with their mobile number.

They must be Indian Citizen.

They have also PAN card.

They have Andriod based mobile phone.

Is Tide a Bank ?

No, Tide is not a bank but it’s an online business financial platform. In the Uk, more than 1 in 13 small business owners choosing Tide and We are one of the leading provider of digital banking services in UK as well. Now, we are moving out from Uk and make Global Presence between young and small entrepreneurs Including India. In India , we are offering the Tide Business Account and Tide expense Card will help small business owners and freelancers to manage expense in the better way.

How much times it takes to open a Tide Business Account?

It takes only a few minutes to open a Tide Business Account. You only need to download Tide Business App.

How can I add money to the Tide Expense Card?

Add the money to the Tide Expense Card by using UPI and Internet Banking .

What is the Tide Business Account?

The tide business account and tide expense card track spending and business expenses, enable transactions at all Rupay accepting merchants.

How Will I receive the Tide Expense Card ?

You will receive the Tide Expense Card within 5 to 7 working days after completing the Video KYC through post, its depends upon your location. Once, you receive the card kindly activate it through Tide Business App.

Where will I receive the Tide Expense Card?

The Communication Address you mentioned at the time of Registration Process.

How Can I use my Tide Expense Card?

You can make payments at all Rupay card accepting merchants offline and online with the Tide Expense Card.

What can I do If I face any issue with the Business Tide App?

You can chat with us through Tide Business App or mail us at indiasupport@tide.co