How to Open Tide Business Bank Account in India

Tide Bank operates as an electronic money institution, providing business banking solutions to small enterprises, freelancers, sole traders, and registered limited companies in India and UK. Unlike traditional high street banks, Tide eliminates physical branches, allowing you to handle your Tide business account entirely online.

Opening an account with Tide is free, and as a business owner, you can obtain a Tide card as well as expense cards for your employees. Tide Bank offers an extensive array of banking services for UK and India businesses.

Table of Contents

Benefits of Tide Business Account

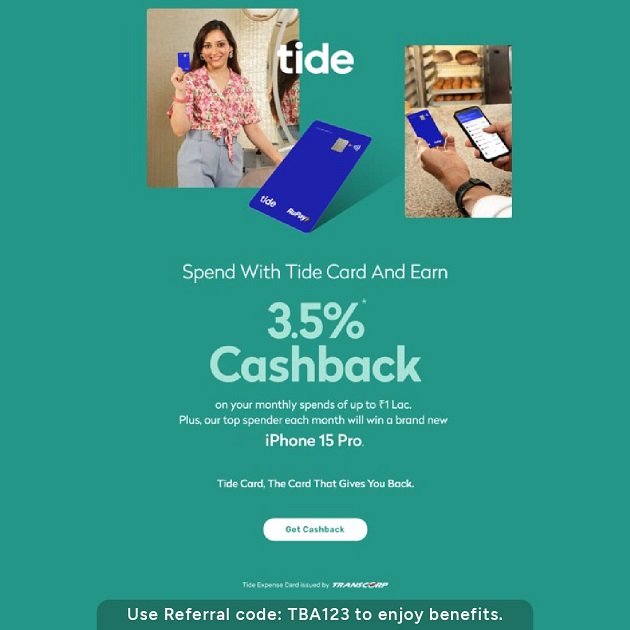

Enjoy exclusive offers with the Tide Expense card! Stand a chance to Win:

Get 3.5% cashback. The more you spend, the more you earn.

Enter the iPhone 15 Pro Giveaway. Don’t miss out on the grand prize.

Open your online Business Account with Tide Business India.

Swift online account setup.

Effortlessly manage and schedule payments.

Generate GST-compliant invoices for free.

Streamline expense management.

Directly manage debits through the app.

Use referral code: TBA123

Get all you need from your business bank account.

Join over 500,000 limited company owners, sole traders, and freelancers who have chosen a Tide business bank account.

Sign up today for free. Pay only for what you use, with minimal transaction and ATM fees.

Create, send, and track invoices via the Tide app for quicker payments.

Seamlessly integrate your accounting software and bank account for effortless reporting.

Benefit from 24/7 account monitoring to ensure the safety and security of your money.

Initiate a chat and receive assistance within the app anytime, 365 days a year.

Tide Business Account Opening Process

Customers need to fill in basic details via the provided link ( https://bit.ly/3wleQug ) and will then be directed to download the Tide Business India App from the Google Play Store.

Provide Email Address and Mobile Number.

Click on ‘Add a referral code’ and input TBA123, then proceed to ‘Next.’

Complete email address verification and set an alphanumeric password with a minimum of 14 characters.

Enable biometrics and complete mobile verification via OTP.

Enter personal details such as name, date of birth, PAN, permanent, and communication address.

Provide business details including company name, address, business category, etc.

Select the relevant business category from the provided list.

Enter OTP again and proceed for VKYC (Video KYC).

Provide consent, proceed, enter your AAdhar number, and complete verification via OTP.

If the customer is already registered on Digilocker, input the 6-digit Security PIN.

Upload the original PAN Card photo and proceed to enter occupational details.

Complete the VKYC process, which includes a live selfie.

Ensure the original PAN card is handy as a photo will be taken during vKYC.

Once the customer account is successfully opened (confirmation email received), the customer needs to deposit at least 1000 within 7 days of account opening.

You might be interested in Personal Loan for salaried employee

FAQs

Who can open a Tide Business Account?

To become a Tide member, applicants must meet the following conditions: They must be over 18 years old. Their Aadhar must be linked to a mobile number. They must be Indian citizens. They must possess a valid PAN Card. They must use an Android-based mobile phone.

Is Tide a bank?

No, Tide is not a bank but a business financial platform. In the UK, with over 1 in 13 small business owners choosing Tide, we are the leading provider of digital business banking services. We are now ready to go global and empower entrepreneurs like you. In India, our current offering of the Tide Business Account and Tide Expense Card (in partnership with Transcorp, a licensed PPI issuer) will help small business owners and freelancers better manage business expenses. We also look forward to providing you with a comprehensive set of highly usable administrative solutions in the future to help you save time and money.

How long does it take to open a Tide Business Account?

Opening a Tide Business Account with us takes only a few minutes. No appointments or queues required.

How can I add money to the Tide Expense Card?

You can add money to your Tide Expense Card using UPI and Internet banking.

What is the Tide Business Account?

The Tide Business Account and Tide Expense Card track spending and business expenses, enable transactions at all Rupay-accepting merchants, and together help businesses save time and money. We also look forward to offering facilities such as invoice generation, credit services, and payroll management in the future to help businesses manage their finances better.